8 Tips to Save Money Without Sacrificing Your Lifestyle

We’ve all been there—looking at our bank accounts and seeing the effects of rising prices, making us wonder how we can save money without sacrificing our lifestyle too much.

Luckily, if you’re willing to make some real changes to your spending habits, you can still save money while maintaining your current lifestyle.

Here are 8 tips on how to save money without sacrificing your lifestyle.

Why save money?

Saving money is a great way to secure your financial future, and it’s something that many people want to do but don’t quite know-how.

There are lots of things that can factor into why saving money is such a challenge for so many people.

If you feel like you’re trying, but still can’t seem to manage your finances, try implementing some or all of these tips on how to save money without sacrificing your lifestyle.

You just might find yourself on more solid financial footing soon!

8 Tips on how to save money without sacrificing your lifestyle:

Anyone who lives on a budget knows that it can be a challenge to find ways to save money without making major sacrifices.

However, there are a few simple lifestyle changes that can help you to cut costs without impacting your quality of life.

Here are 8 tips on how to save money without sacrificing your lifestyle:

1) Use cash instead of credit cards

Using cash instead of credit cards can make a huge difference in your spending habits.

Studies have shown that when you use cash, you’re more likely to spend less and save more.

This is because money saved on a plastic card feels less real than money saved on paper, making it easier for us to ignore savings goals we might otherwise accomplish.

And since credit card companies charge high-interest rates, using a credit card can ultimately cost you big time in extra fees and interest payments—the exact opposite of what you want if you’re trying to save money!

If you currently use credit cards as your primary payment method, start paying with cash instead.

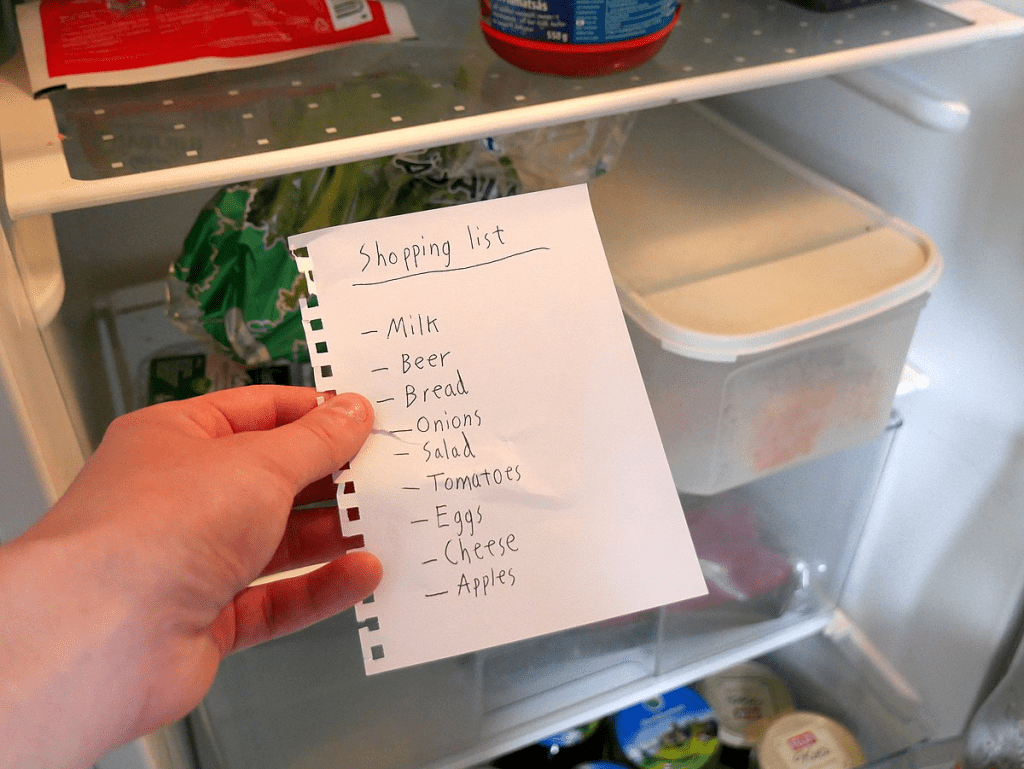

2) Make a shopping list before going to the grocery store to save money

Saving money on food is often as simple as being smarter about when and where you shop.

As tempting as it may be, don’t make your grocery run at 10 p.m. or on an empty stomach!

The best thing you can do before hitting up your local supermarket is to make a list of what you need and what (or how much) you can afford.

Not only will having a shopping list cut down on impulse purchases, but it’ll help keep your total in check—no matter what time of day or how full your belly is when you get there.

Stick to that list, stick to your budget and save!

3) Cook at home more often

The average American spends about $3,000 per year on dining out, the Bureau of Labor Statistics reports.

That’s a lot of money when you consider that many home-cooked meals are faster and healthier than takeout. Not only that, but those at-home meals are often cheaper too.

You don’t have to become a professional chef, but with a few tips, you can learn how to make even your most complicated recipes at home.

If you want to save money without sacrificing your lifestyle—and time—try cooking more often.

- Consider reading: Having trouble saving money? 10 Reasons why!

4) Become a couponer

If you live in a city or neighborhood with a decent-sized population, couponing can be a great way to save money.

The couponing process is pretty straightforward: look for coupons in print and online, buy items with those coupons (which will often save you additional money), and then stock up.

With a little bit of planning and patience, you could easily save hundreds of dollars per month by becoming an avid couponer.

Even if your schedule only allows time for an hour each week at your local store, remember that it’s all about numbers; even shopping one day per week can help offset rising prices and make life more affordable.

5) Cut back on impulse spending

Most of us have impulse spending habits, even if we don’t realize it.

Fortunately, making a few small changes can help you save money on these unplanned purchases.

One easy way to cut back is simply to keep an eye on your budget or have someone else keep track of you.

You might be surprised at how much money is wasted due to unconscious spending decisions—and how much you might miss those items after a month without them!

Even better: once you adjust to saving that money each month, look at ways that saved cash can be redirected into savings or investments in higher-earning places. For example, $25/month could go a long way toward boosting your retirement fund.

- Consider reading: Why am I so bad at saving money?

6) Adjust your savings strategies

If your budget is feeling squeezed by inflation, consider adjusting your savings strategies.

Your first stop should be an online bank account, which will give you access to higher rates than what most brick-and-mortar banks are offering. (Consider moving your checking and savings accounts over right now.)

These accounts are also safer than traditional banks; their online systems make it harder for hackers to compromise your information.

The next step is developing a budget that gives you more wiggle room in terms of how much you spend each month.

For example, if you usually spend $200 per month on entertainment and dining out (the average American spends $300 a month), cut that amount in half—or even more if possible—until your income catches up with inflationary pressures.

7) Put your FSA and HSA dollars to work

If you’re eligible for a health savings account (HSA) or flexible spending account (FSA), you can make use of them both on medical expenses—which means saving money for your IRA or 401(k) doesn’t have to mean sacrificing other financial goals.

First, know that these accounts are only available if you have a high-deductible health plan.

Also, they’re aimed at people with higher incomes: For an FSA, that means $8550 a year in salary and wages; $2700 if your employer pays half; and $5750 if it’s 100% coverage.

8) Rethink your home upgrade

If you have an upgrade project in mind—from painting your living room walls to new countertops in your kitchen—there are several ways you can save cash while still getting all of that brand-new shine.

You could opt for cheaper options and lower-end brands, but they may not last as long or provide you with all of those quality details.

Another solution is to do a few upgrades yourself.

Not only will doing some work yourself help keep costs down, but it’ll also teach you about home improvement; once you understand how certain home improvements work, there’s a good chance that next time around, you won’t even need professionals.

Conclusion

It’s easy to get carried away when you think about how much you could save.

The key is avoiding unrealistic measures that will be difficult for you to sustain in your daily life.

There are plenty of small changes that won’t drastically impact your lifestyle and still make a huge difference over time.

These may seem like simple changes but they can add up over time; by looking at these small adjustments realistically, you can see real savings in your budget.