Why Am I So Bad At Saving Money?

It’s no secret that most of us have hard time-saving money.

A recent study found that 43 percent of Americans couldn’t cover an unexpected $400 expense.

If you’re one of those people who struggles to save, you’re not alone.

But why is it so hard for us to save money?

In this article, we will try to break down ten reasons that may be the reason why this happens.

The psychology of spending

We’ve all been there – standing in the checkout line with a cart full of items we don’t need and convincing ourselves that we deserve this little treat.

But why do we do it? Why are we so bad at resisting the urge to spend money on things we don’t need?

There are a few psychological reasons why we struggle to stick to our budgets.

For one, we tend to overestimate our self-control.

We think we’ll be able to resist the temptation to spend, but when the time comes, we give in.

Another reason is that we’re bad at predicting how happy a purchase will make us.

We think that new shoes or a new car will make us incredibly happy, but the reality is that the joy from material possessions is often short-lived.

Finally, stores and advertisers are experts at playing on our emotions.

They use music, lighting, and other tricks to make us feel good about spending money.

All of these factors contribute to our spending habits, but there are ways to fight back.

If you’re trying to save money, be realistic about your self-control.

Make spending difficult by hiding your credit cards or not carrying cash with you.

And be aware of the tricks retailers use to get you to spend more.

- Consider reading: 8 Financial tips for young adults

Why am I so bad at saving money? – 10 reasons why:

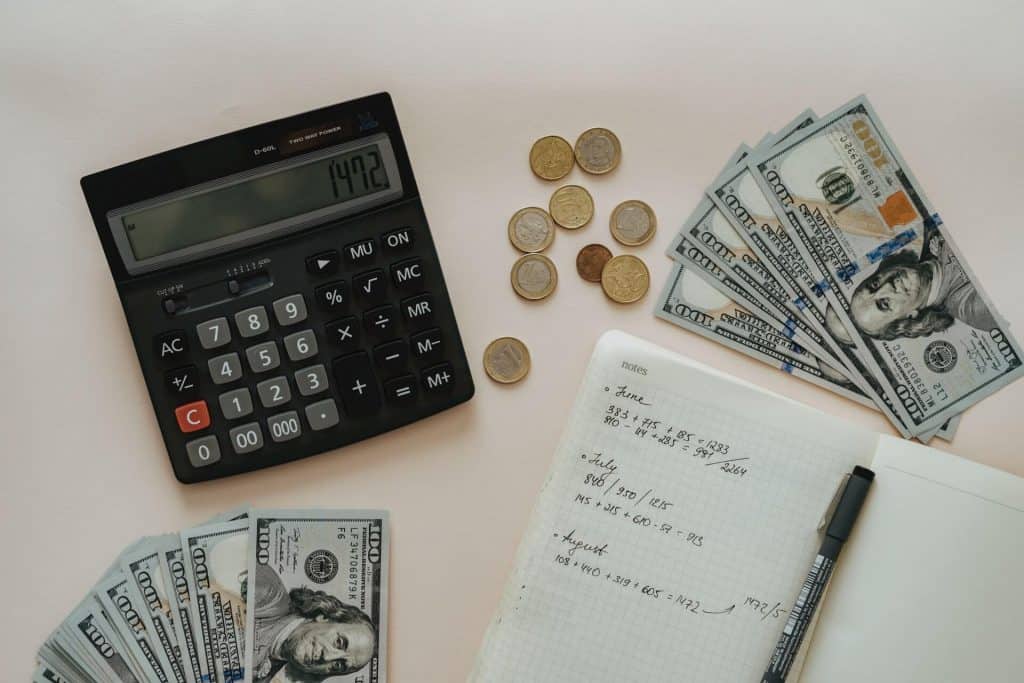

1) You don’t have a budget

Many people think that to save money, you need to be disciplined about spending less.

While that’s undoubtedly important, it’s not the only factor that comes into play.

Another significant factor is having a budget.

Without a budget, it’s very easy to overspend and end up with nothing left to save.

This is especially true if you have irregular income or expenses.

Having a budget helps track your spending and ensure you’re always aware of where your money is going.

It also allows you to set aside money each month for savings.

So if you’re serious about getting your finances in order, one of the first things you should do is create a budget.

You can use this budget calculator to help you get started.

2) You confuse “wants” with “needs”

Everyone has things that they want.

Whether it’s a new car, a fancy dress, or a trip to Europe, we all have our eye on something that we would love to have.

However, it’s essential to differentiate between what we want and need.

Too often, people confuse their wants with their needs, and as a result, they spend money they shouldn’t.

This can be one of the reasons why you are bad at saving money.

If you’re constantly buying things you don’t need, your savings account will suffer.

Instead, try to be more mindful of your spending and focus on putting away money for items that are truly important to you.

By being more intentional with your spending, you can make real progress in your efforts to save.

3) You don’t have patient

One of the main reasons people are bad at saving money is because they lack patience.

They want to enjoy the fruits of their labor immediately instead of waiting and letting their money grow over time.

This is especially true in today’s society, where instant gratification is the norm.

We can order anything we want online and deliver it to our doorstep within 24 hours.

We can stream our favorite TV shows and movies anytime, anywhere.

And we can get instant updates on what’s happening in the world with a few taps on our smartphones.

So it’s no wonder that so many people have trouble saving money – if we can get everything we want right now, why bother waiting?

But the fact is, patience is critical when it comes to saving money.

The more patiently you can wait to spend your money, the more time you will have to let it grow.

And that can make all the difference in reaching your financial goals.

4) You spend more than you earn

If you’re bad at saving money, it might be because you’re spending more than you earn.

It’s easy to do – credit cards make it easy to spend money you don’t have, and it’s easy to convince yourself that you’ll pay it off later.

But the truth is, if you’re spending more than you’re bringing in, you’re never going to get ahead.

You’ll keep digging yourself deeper and deeper into debt.

So if you want to get better at saving money, one of the first things you need to do is ensure that your spending is in line with your income.

Cut up those credit cards, and start living within your means.

It might not be as fun, but it will be a lot better for your bank account in the long run.

5) You don’t think little amounts can add up

Many people think that saving money is all about making big changes and major sacrifices.

But sometimes, the little things make the most significant difference.

For example, if you’re used to buying coffee every day, it might not seem like a big deal to spend $3 on coffee.

But if you do that daily, it quickly adds up to $90 per month – and that’s $1,080 per year!

So if you’re trying to save money, it’s essential to be mindful of all of your expenses, no matter how small they may seem.

Otherwise, those little expenses can quickly increase and sabotage your savings goals.

6) You don’t automate your savings

When you automate your savings, you’re essentially making it so that you don’t have to think about putting money away for the future.

This can be a big help because it means you’re less likely to make spontaneous purchases with the money you were planning to save.

In addition, automating your savings can also help to keep you accountable.

If you know that a certain amount of money will be taken out of your account every month and put into savings, then you’re much less likely to spend it carelessly.

Overall, automating your savings is a great way to ensure that you can save money in the long run.

7) You don’t have saving goals

Many people find it difficult to save money, and there are many reasons why this may be the case.

One of the most common reasons is that people do not have specific saving goals.

It can be challenging to stay motivated to save money if you are not working towards a particular goal, such as buying a house or taking a trip.

Without a goal, it is easy to justify spending money instead of saving it.

The bottom line is that anyone can save money, regardless of their goals.

The key is to start small and make regular deposits into a savings account.

Over time, the account will begin to grow, and you’ll be well on your way to financial security.

8) You don’t have an emergency fund

An emergency fund is important because it gives you a cushion to fall back on if you suddenly lose your job or have unexpected expenses.

Without an emergency fund, you are much more likely to start dipping into your savings account every time something comes up, making it very difficult to save up any significant amount of money.

If you don’t already have an emergency fund, now is the time to start one.

Begin by setting aside a few hundred dollars each month until you have enough to cover at least three months of expenses.

This will give you a much better chance of sticking to your savings plan in the long run.

9) You may have vices that eat away your savings

Many people have a hard time-saving money, and there are all sorts of reasons why this is the case.

For some people, it’s simply a matter of not having enough income to cover their expenses.

Others may have trouble controlling their spending habits.

But in many cases, the root cause of the financial difficulty is quite simple: vices.

Whether it’s smoking, drinking, gambling, or something else entirely, addictions can quickly consume your income and leave you with little to nothing in savings.

Even if you’re otherwise responsible with your money, it can be too easy to fall into the trap of using your savings to support your habit.

As a result, if you want to be good at saving money, it’s essential to be aware of your vices and make an effort to keep them under control.

10) You haven’t started investing

One of the biggest mistakes people make when saving money is not starting to invest early enough.

If you’re not investing, your money is essentially just sitting in a savings account accruing interest at a rate that’s probably lower than inflation.

In other words, you’re losing money by not investing.

Investing allows you to grow your money while taking less risk than gambling or stock picking.

And the earlier you start, the more time you have for compound interest to work magic.

So if you’re not already investing, now is the time to start.

Your future self will thank you!

The benefits of compound interest

Essentially, compound interest means you earn interest not only on your original investment but also on the accumulated interest from previous periods.

This can cause your investment to grow faster than if you were earning simple interest.

For example, let’s say you have $100 in a savings account that earns 10% annual compound interest.

After one year, you would have earned $10 in interest, so your balance would be $110.

The next year, you would earn 10% of $110, or $11 in interest.

So after two years, you would have a balance of $121.

As you can see, your balance grows a little bit larger each year because you’re earning interest not only on your original investment but also on the accumulated interest from the previous year.

This growth can add up over time!

Compound interest is one of the most powerful tools for building wealth, which is why it’s so important to start saving and investing as early as possible.

Even small amounts of money can grow into sizable sums if given enough time to compound.

So if you’re looking to build long-term wealth, make sure you’re taking advantage of compound interest by starting to invest early and letting your money grow over time.

How to create a savings goal and stick to it?

Creating a savings goal can help you stay on track financially and achieve your long-term objectives.

However, sticking to a savings plan can be difficult, especially if you have a limited budget.

Here are some tips to help you create a savings goal and stick to it:

- Start small. Setting a large savings goal can be overwhelming if you’re starting. Instead, focus on saving a smaller amount each month. As you get used to the process, you can gradually increase your savings goal.

- Automate your savings. One of the best ways to make sure you stick to your savings plan is to set up automatic transfers from your checking account to your savings account. This way, you’ll never have an excuse for not saving.

- Set a deadline. Having a specific date in mind for reaching your goal can help motivate you to save. Make sure the deadline is realistic, so you don’t get discouraged if you don’t reach it immediately.

- Make it fun. Saving money doesn’t have to be boring! To make it more enjoyable, set up a reward system for yourself so that you can treat yourself after reaching each milestone.

Following these tips can help you create a savings goal and stick to it.

However, remember that saving money is a marathon, not a sprint.

Don’t get discouraged if you don’t reach your goal right away.

Just keep working at it, and eventually, you’ll get there.

Why am I so bad at saving money? – Conclusion

Saving money can be difficult, but it’s not impossible.

If you’re struggling to save, consider your spending habits and see where you can cut back.

Automating your savings can also help make the process easier.

Finally, don’t forget to set a realistic goal and reward yourself for reaching milestones.

You can learn how to save money and reach your long-term financial goals with little effort.