Best 52 Week Money Saving Challenges for Every Budget

You’ve probably seen that 52 week money saving challenge that promises you’ll have over $1,000 saved by the end of the year. It starts easily enough by asking you to save $1 the first week, $2 the next, $3 the week after that, and so on. Sounds great, right?

Well, there’s a catch.

By the time you get halfway through the year, the challenge asks you to take $25 or $30 or more out of your paycheck every week.

I don’t know about you, but I don’t have that much wiggle room in my budget.

If you want to save more money but think it’s out of reach, I have some good news:

You can save money no matter how tight your budget is.

To prove it to you, here are 52 week money saving challenges that can work for any budget. Pick one to help you save more and reach your financial goals this year.

Best 52 Week Money Saving Challenge Ideas

1. Mini Money Saving Challenge: Save $689

Even for the tightest budget, this money saving challenge can work for you. Imagine having almost $700 extra at the end of the year.

You start by setting aside just $0.50 the first week. Every week, you’ll save $0.50 more than you did the week before. Because you’re working with a small budget, most weeks ask you to save less than $20. And you’ll never have to save more than $26 a week.

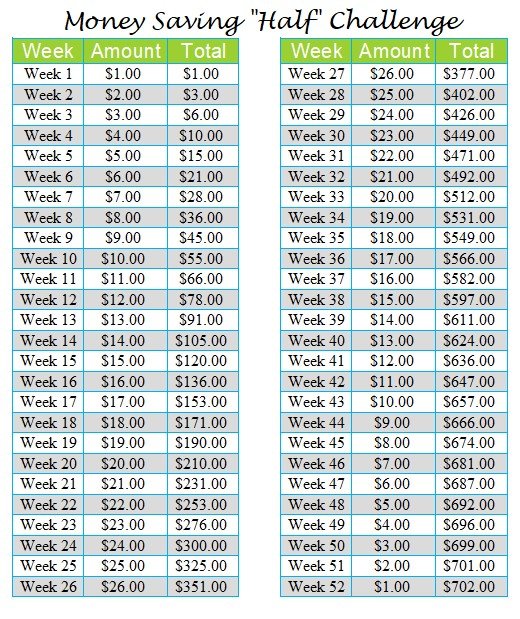

2. Money Saving “Half” Challenge: Save $702

The traditional version of the money saving challenge has you saving over $50 a week by the end of the year. If you can’t swing that much out of your budget, consider the “half” challenge.

To start, you’ll save $1 the first week and an additional $1 every week after that. When you get half-way through the year, the savings challenge asks you to save $26, which can stretch the budget pretty thin.

But that’s the beauty of this challenge:

The pain stops there.

After you reach the half-way point, the amount you save starts to decrease by $1 each week.

Toward the end of the year, you’re saving less than $10 out of every paycheck. And that is totally realistic.

3. Traditional 52 Week Money Saving Challenge: Save $1,378

I couldn’t share strategies to save money without including the original money saving challenge. If you want to give it a shot, I encourage you to try the traditional 52 week money savings challenge! What’s the harm in trying?

You might not make it through to the end but you can modify it as you go to fit your budget.

For instance, you might start strong by saving $1 the first week and $1 more every week after that. But taking more than $30 out of your paycheck every week might be too much for your budget.

And that’s okay!

If you get stuck at week 30 but continue to save $30 each week until the end of the year, you’ll still end up with more than $1,000 in the bank.

I’d call that a win!

You’ll never know if you don’t try. You might surprise yourself and be able to make it all the way through to have the full $1,378 at the end of the year.

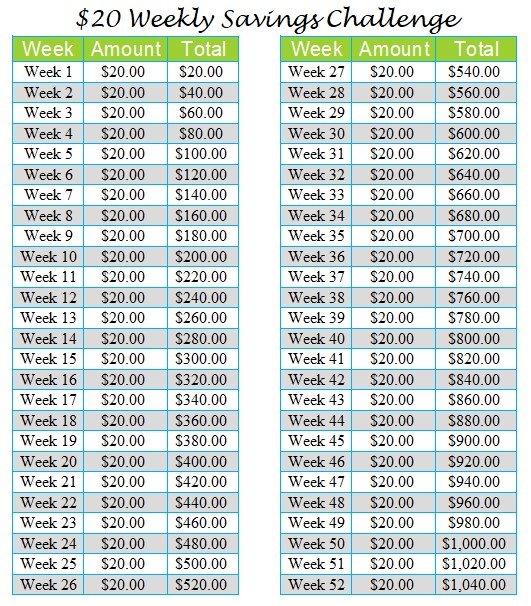

4. $20 Weekly Savings Challenge: Save $1,040

Let’s face it: new habits are hard to stick to. That’s why this next savings challenge is so great – it lets you “set it and forget it.”

Putting your savings on autopilot is the best way to make sure you hit your financial goal. When you automate your savings, you don’t have to worry about remembering to transfer the cash. Plus, you know what they say, out of sight is out of mind, right?

Contact your employer to set up direct deposit to have $20 taken out of each weekly paycheck.

With your cash automatically going into savings, you won’t even miss the money because it never made it to your account in the first place.

5. $10 Weekly Savings Challenge: Save $520

Not everyone can spare $20 a week out of their budget. Still, the “set it and forget it” method is one of the easiest ways to get your savings on the right track.

With the $10 weekly savings challenge, you could rack up $520 by the end of the year without sacrificing your other financial goals.

Like the $20 weekly challenge, you’ll want to set up direct deposit to automatically take $10 out of your paycheck every week.

Then you can sit back and relax while your savings piles up.

6. Monthly Money Saving Challenge: Save $720 – $1,800

The monthly money saving challenge gives you the chance to pay yourself once a month, just like any other bill.

How much you save depends on how much you can afford to transfer to savings every month.

Remember: the point of a money saving challenge is to challenge you.

Don’t settle for saving $20 a month if you can afford to save $60 or more.

Here are two variations of the monthly money saving challenge. The first gets you to $720 after a year. The second option will help you save $1,800 over the next 12 months.

How Much Will You Save?

Saving money is like flossing. You know you need to do it, but you keep putting it off.

It’s time to stop making excuses.

No matter how tight your money is each month, there are plenty of ways to make room in your budget.

Start a side hustle, cut down your grocery bill, pack your lunch instead of eating out when you’re at work, or turn the thermostat down to save on energy costs.

Here’s the bottom line:

You can save money.

If you’re worried you won’t follow through with your savings goal, use the “set it and forget it” method of saving to set aside the same amount each week. Fill out a direct deposit form to automatically transfer the cash to a savings account, and you’ll reach your goals before you know it.