18 Money Saving Challenges To Jump Start Your Savings

Hello, beautiful friends of the internet! It is so wonderful to have you here! Welcome back to another blog where we talk all about finances and becoming financially abundant. Going into 2022, I think we can all agree that it’s time to change our spending habits.

Maybe it’s just me, but I spent way too much money online this year. Partially because I was bored. And the other part was because I didn’t know how to save money properly!

So, have you decided that you want to start saving money? Still, you are finding it challenging and unmotivating to do so?

Don’t worry, I’ve been there. I think we all have! That’s why I have come up with some fun money saving challenges that will not only help you save money, but are also fun to do!

And trust me when I say that I just started using some of these money saving challenges a couple months ago, and I can already see a significant difference in my saving habits! Let’s get started, shall we?

18 money saving challenges

Here are some fun and exciting challenges that will help you on your way to saving money without any difficulties!

I promise there is something on the list for everyone, so take a look and keep an open mind! Let’s get right into it, shall we?

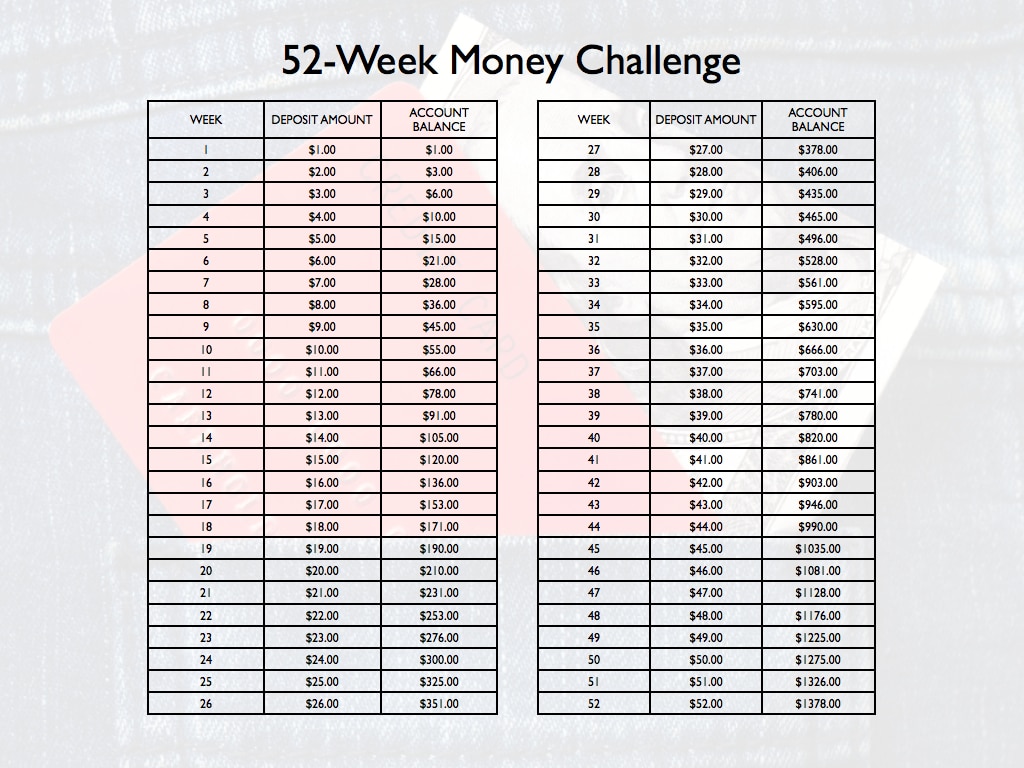

1. 52-week saving challenge

This is one of the most popular money saving challenges on the internet if you are googling ways to save money. And it’s popular for a good reason! The point of the challenge is that you are consistently putting money away each week for the full year.

Seems easy enough, right it is! How you play this challenge is you start off the first week of the month by putting $1 away on the first week, $2 out on the second week, and so on.

If you kept this trend for the entire year, you would have a grand total of $1378. Which is not so bad if you ask me!

However, if you want to save up more money, you can always start off with a higher amount such as $5 the first week, $10 the second, and so on—you get the point!

While this challenge is most common amongst people trying to save money, it’s not the most fun one on the list that I am about to provide you with. I think we can do a little better. What about you? Let’s take a look at some more challenges.

2. No-spend month challenge

My friends and I use to do this all throughout high school back in the day. And while some of us had troubles staying on track, most of my friend group was able to stick with it for the entire month.

Now, this may be a little harder when you are an adult, and you have bills to pay. However, you can still do this challenge by making it a no spend month minus your bills. Easy peasy.

Do you think you could last the entire month? I’m talking no margaritas, trips to the mall, Starbucks, and more. This challenge is a true testament to your willpower! Do you have what it takes?

3. Spare money challenge

This is one of the excellent money saving challenges. How you do this challenge is by saving your spare change from the entire year.

Get yourself a piggy bank or even a glass jar and put your spare change into the jar every time you find it lying around the house or in your pockets.

Now depending on how much difference you end up putting into the piggy bank, I don’t suspect you would have more than a couple hundred at the end of the year.

However, if you are looking to save more money, you could do a $5 or $10 money challenge where you put all your 5s and 10s into a jar for the year and didn’t spend it until the end!

Now, this is a bit harder to do. However, it will be totally worth it at the end of the year when you are rolling in a couple thousand!

4. The money envelope challenge

The money envelope challenge is one of my favorite challenges. What you are going to want to do is get yourself 52 envelopes and write amounts of money on them. You can write anything from $1 – $100 on the envelope.

Once you have written all the amounts onto the envelopes, you will want to shuffle the pile and place it into a box.

Every week for one year, you are going to randomly select an envelope from the box and deposit that much money into the envelope! You can play this money saving challenges by yourself or with a partner!

The fun part is not knowing what you are going to have to put in each week. You are sure to have a decent amount of money in there at the end of the year as well!

5. Try not to buy coffee for a year

This one is going to be a tough one for a lot of people, and trust me, I am one of them. There is nothing more that I love than a cinnamon dolce latte from Starbucks every morning.

And let me tell you, before I was actually checking to see how much money a month I was actually spending on Starbucks drinks a month I was completely blinded by my latte addiction.

It’s so easy to reload your mobile Starbucks card without seeing the money come out of your bank account, and that was truly one of the downfalls of my 2020 year.

But hey, the first thing to getting treatment for your addiction is admitting you have a problem. And I definitely have a problem. That’s why I’ve made the executive decision to cut Starbucks out of my life in 2022. Cue the tears, I know.

But when you think about how much each coffee costs and then add it up for the month, you will be shocked. So maybe we should all try and make coffee at home for the next little bit.

6. Holiday fund

We all know that the holidays are about giving. And that’s great and all when you’re the one getting gifts. Spending money on gifts, on the other hand, can be incredibly damaging to your bank account.

That’s why if you put away $20 a week into a holiday fund, by the time December rolls around the corner quicker than you ever expected, you will be prepared to buy gifts and not debilitate your savings accounts.

Seriously you guys, hop on this trend. I promise you won’t regret it! You can even throw yourself a gift as well!

7. Meal plan money saves a challenge

I ultimately made that title up. Don’t judge me, okay? The point I am trying to get across is that eating out is expensive. Uber and Skip the Dishes have been robbing me all year! I swear I don’t know how it happened, but it did, and now here we are.

Eating out is excellent, but when you are eating out a couple times a week or month, that can seriously put a devastating toll on your bank account.

By sitting down and planning out your meals for 30 days and then actually cooking at home all 30 days, not only will you save money, but you will also start to feel healthier!

Who knows, you might even do so well with this challenge that you will cut eating out from your routine all together! There’s totally nothing wrong with that if you ask me!

8. Weather Wednesday challenge

Before you roast me, this name I didn’t make up is an actual challenge name, okay? The weather Wednesday challenge is quite simple and straightforward.

Every Wednesday of the year, you will check the temperature in your state or country and put that much away for the week.

This will most likely work better for people in the United States because you guys still use Fahrenheit. In contrast, the rest of the world uses Celsius (something that even doesn’t make sense).

Before the rest of our audience thinks they can get out of this one, if you live in a place where the temperature is measured in Celsius, you have to use a converter and change it to Fahrenheit.

I’m sorry, that’s just how the rules work; you can go changing them now. This money-saving challenge is a great way to save money quickly, so definitely take advantage of this if you can!

9. Track your expenses challenge

Now while this isn’t a direct saving money challenge, it can still technically help you save money, which is why I have included it on the list. What you are going to want to do is start tracking every last penny you save a month.

That’s right, you read that correctly. Every dollar you spend, you will need to keep track of.

You can use a spreadsheet, collect your receipts, or write it down in a journal –whatever works best for you so you can remember to keep track of it what you are spending.

By writing the amount of money you are spending down, you will become more aware of what you are actually spending! That way, you can start saving more and spending less!

10. The dollar store swap challenge

If you have ever been to a dollar store, you’ll know that everything in there is, of course, a dollar. They sell anything from greeting cards to kitchen utensils. You name it, they have it.

So, why not start buying little things here and there from the dollar store? I’m not saying you have to buy any food (don’t trust the food).

However, the dollar store does actually sell name brand kitchen accessories and cleaning supplies like soaps and sponges, etc.

So instead of spending $5 on a box of soap, why not pay a dollar? It’s basically free money in your wallet at the end of the day, so why not try switching out a couple of things here and there?

11. The generic swap challenge

Now, if you aren’t as excited about the dollar store swap challenge as I was, it’s okay; I get it. That’s why I’ve come up with the generic swap challenge.

For those who may not catch on as quickly as others, the generic swap is basically where you cut out name brand items such as food and cleaning items with the generic brand version.

Contrary to popular belief, my friends, the generic brand is just as good as the name brand, and it costs half the price!

If you want to save money, try and do your whole grocery shop by buying all your products generically, comparing your bill to another bill, and seeing how much you save.

I’m serious, guys; the deals are crazy, so this is the perfect challenge to start implementing in your life!

12. The bi-weekly challenge

The bi-weekly money saving challenge is as easy as they come. Since everyone gets paid bi-weekly, you should begin making it a habit to take a bit out of each pay cheque and put it towards your savings.

This way, you are systematically creating a routine that is easy to follow, and you never have to miss a day. It’s that simple!

You can even set up an automatic deposit into your savings every two weeks, so you have no excuses as to why you haven’t contributed to your savings every month.

You decide how much you want to put away every two weeks. Just make sure that it is a meaningful amount that is actually going to make a difference in a year.

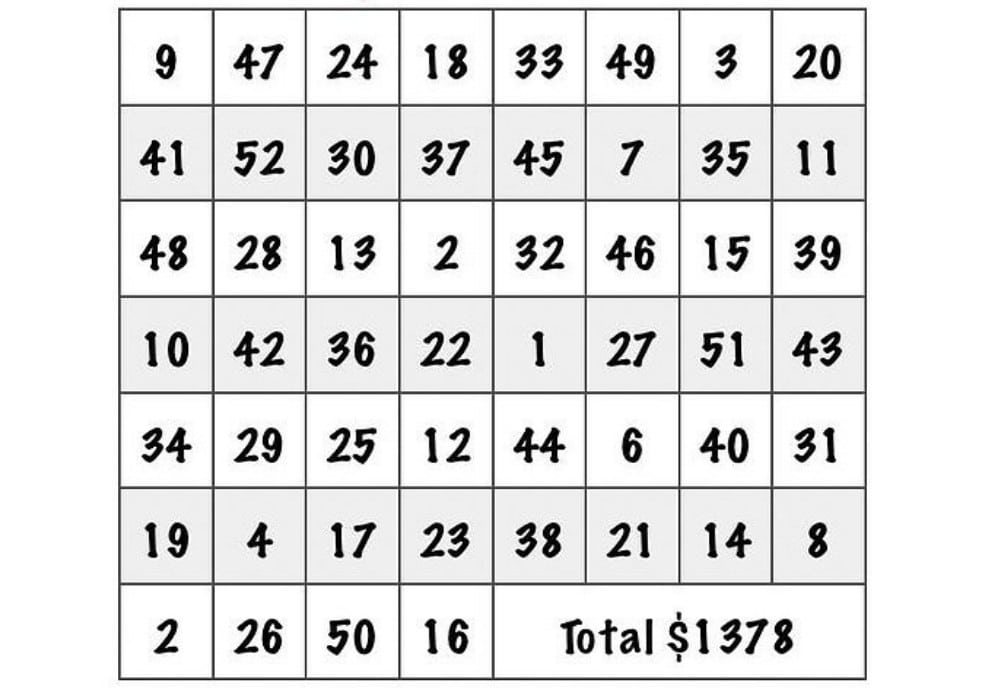

13. The money-saving bingo challenge

Who said saving money can’t be fun? For the money-saving bingo challenge, what you are doing to want to do is download a premade template online. You can find these by searching money bingo templates on google.

Each day for an entire month, you are going to draw a bingo chip and cross off that amount from the bingo square and save that amount of money. After the full month is over, you will have saved $500!

How amazing is that! You can even create your own bingo board if you want to save more or less money a month! It’s totally up to you!

14. Color challenge

This is one of my favorite money saving challenges. What you are going to do is print up one of those money goal posters from Google.

You know the ones that they would always have around the school when they were trying to save money for a charity? Ah, yes, we’re ringing some bells now, aren’t we!

Once you have printed out the picture, paste it onto your wall, and put the amount you want to save at the top.

Every time you deposit some money into your saving, you get to color in part of the tracker!

Having a visual and actively filling in a little bar on the tracker is not only a great way to see where you are in your savings goals, but it is also a great way to stay motivated to fill in the entire tracker in a certain amount of time!

You should definitely check this one out! You can get as crazy as you want with this as well. It doesn’t have to be a tracker. It can be any type of photo you want!

15. Receipt saving challenge

Every time you spend money, ask for your receipt! Now go all the way down to the bottom and see how much your savings were. You should find this after your grand total at the bottom.

Whatever your savings amount was for that shopping trip, you will put that amount into your savings account! Easy enough, right! This is a great way to consistently save money, especially when you buy little things here and there!

So, take advantage of this while you can and start saving your money today!

16. Bad habits saving jar

We all have bad habits. It’s a part of being human! This challenge is a win-win for everyone. Not only will you start saving money, but you will also wait for those bad habits you have been wanting to stop for a while now.

Now, how do you play this money-saving challenge, you may ask? Well, get a jar and label it the bad habits jar.

Now every time you make a bad habit such as skip your workout, swear or sleep in until noon, you will put a certain amount of money into the jar.

The more you continue with your bad habits, the more money you have to put into the jar. When you have stopped all your bad habits, you get to spend that money.

17. Get competitive with saving your money

If you find it hard to save money, why not up the stakes and challenge someone to save money with you? This could be a friend, sibling, or partner!

Whoever saves the most money wins the challenge. Whoever loses will have to buy something for the other person.

This challenge is simple enough, and it can make you quite motivated if you are up against someone! Everyone loves a bit of friendly competition!

This is great to not only save money but to also have fun while doing so! What are you waiting for? Start challenging your friends today!

Also, check out if and how you can plan your own finances.

18. The pantry challenge

Do you find yourself continuously buying new snacks for your pantry when there is still a lot of food left in the pantry from last week? If you answered yes, then this challenge is for you.

What you are going to want to do is hold off on buying snacks or things in your freeze/fridge until you have absolutely no food left.

Now, this might be easier when you live alone and don’t have kids, but it’s still worth a try! No buying new snacks until the ones in the pantry are finished.

We tend to stock up a lot on food that never really ends up getting eaten. It will either say in the pantry for months or go expired before anyone actually opens the container.

Therefore, if you make it a habit to hold off on buying food until the rest is eaten, you will not only save a ton of money, but you will also stop wasting food! It’s a win-win situation if you ask me!

Final thoughts

And there you have it, my friends! Another money-saving blog post to help you on your way to becoming financially abundant! Remember, these money saving challenges are meant to help you find the fun in saving money, but they aren’t necessary.

I do, however, encourage you to try them out! You never know one of these challenges. You help you out more than you know! If you are more of a traditional saver, you can always burn the old budget instead of having fun (I’m only judging a little bit).

In all seriousness, though, I know saving money can be challenging, especially when you feel like you aren’t making enough money to save in the first place.

However, it’s all about living within your means and keeping yourself accountable! You can get as creative as you want when it comes to saving money as long as you are actually following through and seeing a difference in your bank account!

That’s it for now, my friends! Thank you again for stopping by. You know it’s always a slice here on my page. Until next time my friends. Keep it real and good luck with your savings!

Make sure to leave a comment down below to let me know which challenge you chose to do! You can even leave a comment informing us if you have any other challenges to save money that I didn’t mention! Bye for now!