Why I Got My Teenager a Debit Card

I never had a checking account as a teen. My parents were like most parents: They never talked about money. Everything I know about money, I had to learn on my own.

Which means I didn’t manage money very well in my 20s.

Now that I’m a personal finance nerd, I talk about money all the time. Making sure my daughter, Nora, has a solid grasp of how a budget works is important to me.

The path to a teen checking account

My husband and I have given Nora an allowance since she was very young. We began teaching her the 3 “bucket” you should always put your money in:

- Giving

- Saving

- Spending

She’s had a savings account since she was a baby. I’d deposit her birthday or Christmas money and she started adding money from her allowance.

Now that she’s a teenager, her allowance is bigger. (For all you parents who are wondering, she does chores to earn her allowance. It isn’t free money for her.)

And that means she has more money to spend.

Like most 14-year-old girls, some of Nora’s favorite things to buy include clothes, makeup, and expensive drinks from Biggby.

She pays with cash.

I’m a huge fan of paying with cash. There’s less of a chance you’ll go over budget. When your cash is gone, you stop spending!

Since 70% of Americans prefer card payments over cash, Nora will need to learn how to spend with plastic sooner or later.

It makes more sense to give her that freedom now while I still have some influence.

By the time she’s 18, she’ll have her own ideas of how life with a debit card should work.

Why we chose a Capital One MONEY teen checking account

Few banks offer checking accounts and debit cards to teenagers. After narrowing down the ones that do, I sifted through the features.

I wanted a teen checking account with:

- No fees

- No minimum balance

- Fee-free ATM access

- Parent access

- A debit card in her name

The Capital One MONEY account checked all of those boxes. Plus, I already have a savings account with Capital One, so I knew it was a decent bank.

Nora is the primary account holder, but my name is also on the account. That means I can see her balance and transaction history by logging into my Capital One 360 account.

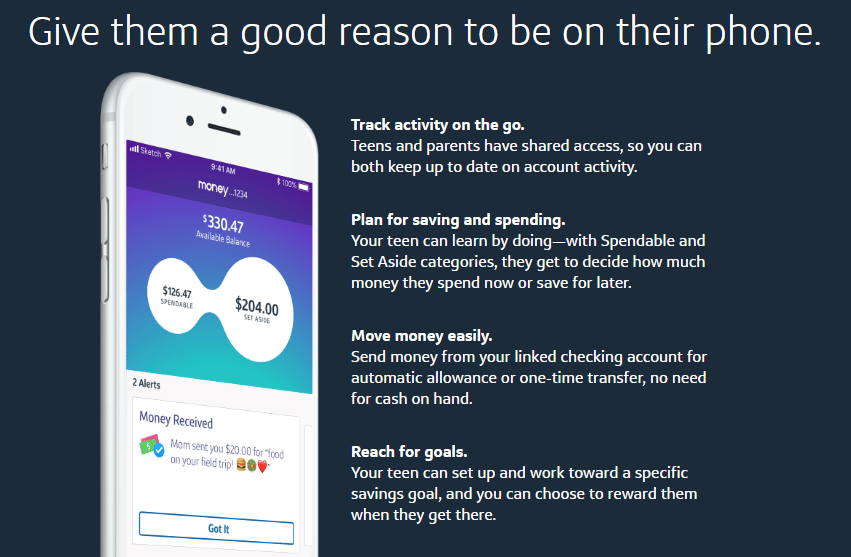

The app has a unique feature that’s perfect for teaching teens the importance of saving.

When you log in, you have two “buckets” to keep your money in. One is “spendable” and the other is labeled “set aside.”

Nora can set aside some cash in her checking account for a savings goal without needing to have a separate savings account.

Plus – and this one is a completely selfish perk – giving her an allowance every month is easier than ever. I log into my bank and to a simple transfer to her account.

I used this feature twice already this month. At the beginning of the month, I transferred her regular monthly allowance.

Last week, she cleaned the shower.

Now let me tell you:

I hate to clean the shower.

I pay Nora $10 to do it for me. It takes her about 20 minutes at most.

Instead of making an extra trip to the bank to take out cash, I transferred the money from my checking account to hers.

It was so nice!

How we’ll use the teen checking account

Nora hasn’t used her debit card yet.

We’re in the middle of a coronavirus outbreak and everyone is under a “stay at home” order. Most of the local businesses are shut down, so there isn’t much to do outside of the house, anyway.

Assuming school starts again this fall (and doesn’t get postponed because of COVID-19), she’ll be responsible for budgeting and buying everything she needs for back to school.

Our plan is to transfer a lump sum to her checking account and talk her through each purchase.

We’ll cover the items she needs to purchase, such as school supplies and clothing, and talk about how to shop for the best price.

I’ll also teach her how to use a checkbook register and how to balance a checkbook.

She’s 14, which might not seem like she’s old enough to have a debit card or all this responsibility around money.

But Nora only has four years left until she’s out on her own. I hope she sticks around while she goes to college, but I have a lot to teach her before then.

One big lesson I want her to learn is the freedom of financial independence. If she can master her money now, maybe she’ll make better financial decisions than I did.

If you’re thinking about opening a bank account for your teen, I recommend Capital One MONEY. It’s designed for teenagers and lets parents monitor spending habits through text alerts or logging into the account.